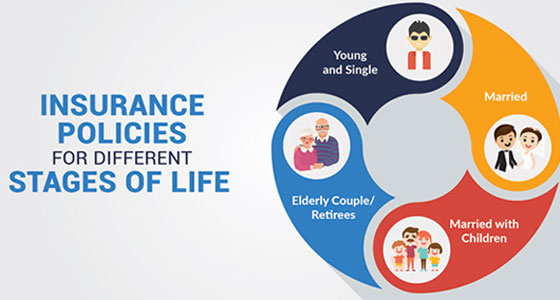

The rise of digital nomadism and remote work has transformed the way people live and work, offering flexibility, freedom, and opportunities to explore the world while earning a living. However, along with the benefits of this lifestyle come unique challenges, including navigating insurance coverage as a nomadic or remote worker. From health insurance to travel insurance and beyond, it’s essential for digital nomads and remote workers to understand their insurance needs and options to protect themselves and their livelihoods. In this blog post, we’ll explore the key insurance considerations for digital nomads and remote workers and provide guidance on how to ensure adequate coverage while living and working remotely.

- Health Insurance: Health insurance is a top priority for digital nomads and remote workers, as access to quality healthcare is essential, regardless of location. While some nomads may rely on travel insurance or international health insurance plans to cover medical expenses while abroad, others may opt for expatriate health insurance or maintain coverage in their home country. It’s crucial to research and compare different health insurance options to find a plan that offers comprehensive coverage, including emergency medical treatment, hospitalization, and evacuation, as well as access to healthcare providers worldwide.

- Travel Insurance: Travel insurance provides coverage for unexpected events and emergencies that may occur while traveling, such as trip cancellations, lost luggage, medical emergencies, and travel delays. Digital nomads and remote workers who frequently travel or relocate to new destinations can benefit from travel insurance policies that offer comprehensive coverage for a range of travel-related risks and contingencies. Look for travel insurance plans that offer flexible coverage options, including coverage for trip interruptions, medical emergencies, and emergency evacuation, to ensure peace of mind while traveling.

- Renters Insurance or Property Insurance: For digital nomads who rent accommodation or own property while traveling, renters insurance or property insurance can provide protection for personal belongings and assets against theft, damage, or loss. Renters insurance typically covers personal property, liability protection, and additional living expenses in the event of a covered loss, while property insurance provides coverage for owned or rented property, including structures, contents, and liability protection. Consider purchasing renters insurance or property insurance to safeguard your belongings and assets while living and working remotely.

- Liability Insurance: Liability insurance protects digital nomads and remote workers from potential lawsuits and claims of negligence, property damage, or bodily injury arising from their business activities or personal actions. Depending on the nature of your work and lifestyle, you may need different types of liability insurance, such as general liability insurance, professional liability insurance, or product liability insurance. Liability insurance provides coverage for legal defense costs, settlements, or judgments in the event of a covered claim, helping to protect your assets and financial security.

- Cybersecurity and Data Breach Insurance: As digital nomads and remote workers rely heavily on technology and digital tools to conduct their work, cybersecurity and data breach insurance are essential considerations to protect against cyber threats and data breaches. Cyber insurance provides coverage for expenses related to data breaches, cyberattacks, and other cyber incidents that compromise sensitive information or disrupt business operations. This type of insurance helps cover costs such as forensic investigations, data restoration, notification expenses, legal fees, and regulatory fines associated with cyber incidents, mitigating financial losses and reputational damage.

Conclusion: Navigating insurance coverage as a digital nomad or remote worker requires careful consideration of your unique lifestyle, work arrangements, and travel plans. By understanding your insurance needs and options, researching different insurance policies, and selecting coverage that provides comprehensive protection for your health, belongings, assets, and business activities, you can safeguard yourself and your livelihood against unforeseen events and risks while living and working remotely. Investing in the right insurance coverage ensures peace of mind and financial security, allowing you to focus on exploring new destinations, pursuing your passions, and thriving in the digital nomad lifestyle.

![Strongman – Scars [Performance Video] Strongman - Scars [Performance Video]](https://www.ghanasong.com/wp-content/uploads/2024/04/Strongman-Scars-Performance-Video-150x150.png)